Ten Rules for Trading Bitcoin, Ethereum, and Other Crypto

#Newsflash 2 February 2018: Binance has disabled New Registrations but you can open a new account using this backdoor. They forgot to close the registration app endpoint in the launchpad server. Open account at Binance.

#30 January 2018: Exchanges are closing doors to new Registrations

One by one, the exchanges are closing the doors to new Registrations under the pressure of excessive demand. Bittrex, Cryptopia, CEX are closed to new registrations. It is still possible to open accounts at Binance, Bitmex, Bitfinex, CoinExchange, COSS, HitBTC, Altcoin.

Exchanges Accepting New Clients

Advice is to to register with these exchanges immediately, while they are still accepting new business:

Bitmex: Leveraged trading

Binance: Largest exchange in the world

Coinexchange: Low-cap alts specialist

COSS: Good for newly listed coins, many post-ICO.

HitBTC: A top-5 exchange with large volumes

Altcoin: a new decentralized exchange operating atomic swaps

Bitfinex: Second largest global exchange.

Exchanges Closed to New Business

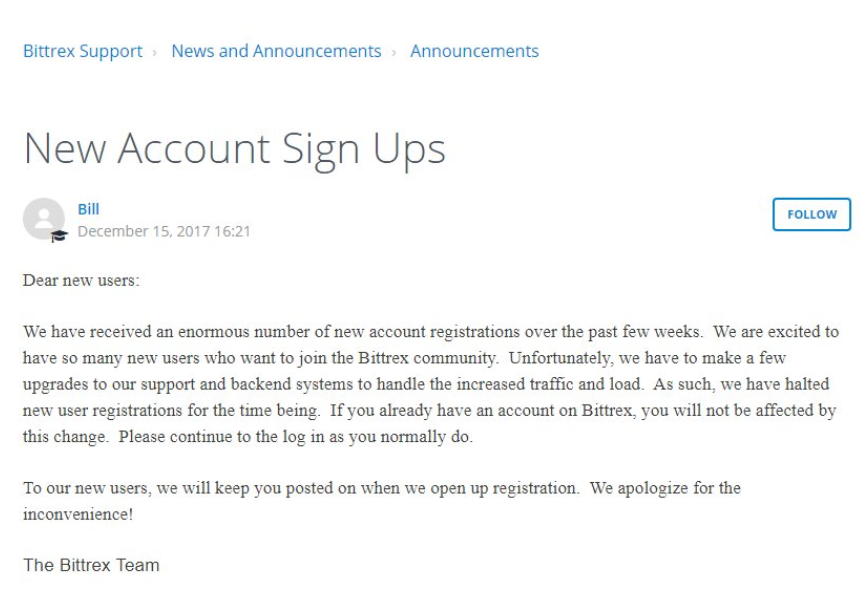

Bittrex halts new user registration:

Cryptopia:

Due to the extremely high number of registrations that have occurred recently we have paused our registration feature while out team works to make changes in our internal systems to cope with the increased level of traffic our site is experiencing.

CEX suspends New User Registrations

#Trading Tip 3 December 2017: Buy Bitcoin on 10x Leverage

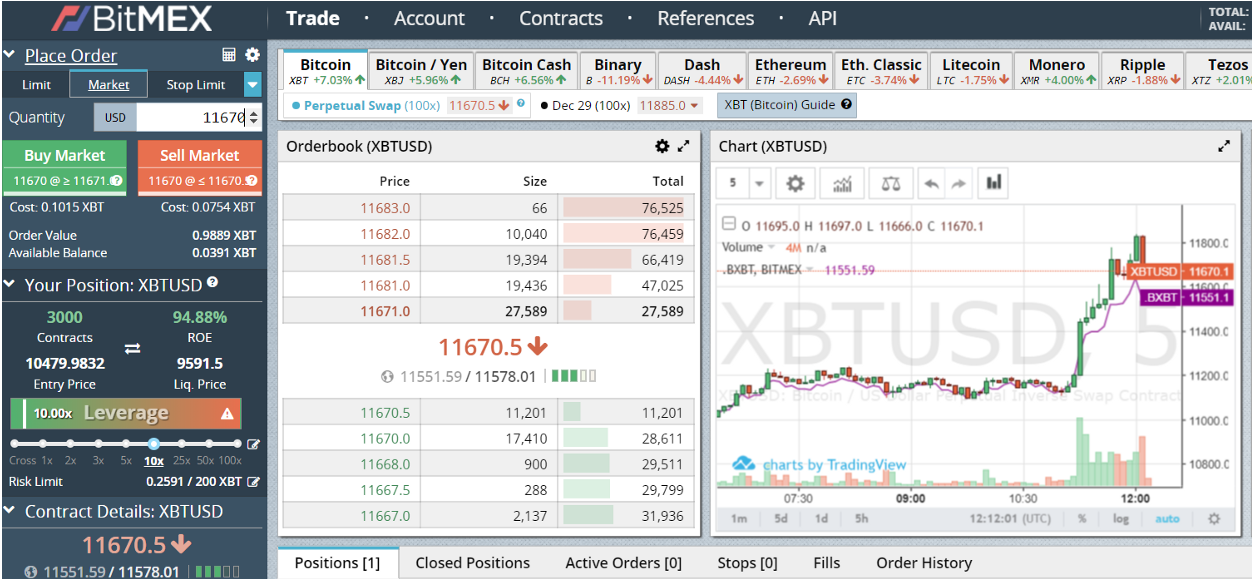

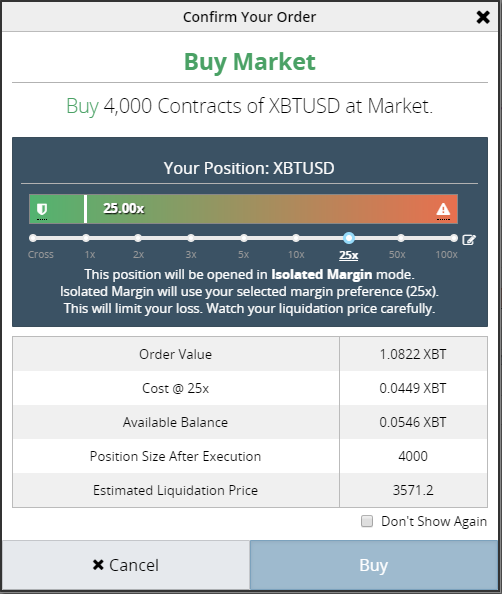

If you like risk you can buy 1 Bitcoin (currently $11,670) with 0.1 BTC ($1,167) by buying a 10x margin position at Bitmex. You might assign a small fraction of your portfolio to this high-risk high-reward trade. Use this link to receive a 10% fee discount. Here is a video tutorial on trading Bitcoin with leverage. Note that you can lose what you stake if there is a large drop in the price.

You can also short the Bitcoin price (profit from a fall in its price) by Selling the Contract.

Set-up to buy 1 Bitcoin ($11,670) with 0.1 BTC ($1,167)

Cost: The cost is 0.1015 BTC i.e. $1,167. This is the maximum you can lose should the price fall by 10% to $10,500. If the price was to crash to $5,000 your loss is still limited to $1,167. This is the beauty of the Bitmex contract. Trading Futures Contracts on the CME, for example, there is no such limited risk facility — you can lose a lot more than your initial margin.

Order Value: The value of your position is 1 BTC i.e. $11,670.

Scenarios

Price rises by 10% to $12,837. Your profit is $1,167, i.e. 100%

Price rises by 20% to $14,004. Your profit is $2,334, i.e. 200%

Price falls by 10% to $10,503. Your loss is $1,167, i.e. 100%

Price falls by 20% to $9,336. Your loss is $1,167, i.e. 100%

I suggest trading with tiny amounts to start with to become familiar with the Bitmex site. Then you can increase your leverage to x100 as you gain competence. (i.e Buy 1 Bitcoin worth $11,670 with 0.01 BTC worth $116.70). A position at x100 leverage is quite likely to make a lot of money quickly or to get wiped out in a matter of minutes.

My general rule in buying Bitcoin on leverage is to buy the dip: you want to see red candles after a period of green candles on the charts. I like to buy at 10x leverage to start with. If the position trades into a nice profit I slide the leverage slider up to 50x or 100x. This has the effect of moving your Liquidation Price up and therefore securing profit.

Margin-trading is available on most of the Top 10: Bitcoin, Ethereum, Bitcoin Cash, Ripple, Dash, Litecoin, Ethereum Classic, Monero, ZCash. Note that the BTC trade is priced against the USD, but these altcoin contracts are priced against Bitcoin.

Another strategy I use is to keep a 10x leveraged long position on Bitcoin permanently open on Bitmex. When the market rises then take profit off the table. My position gets closed out periodically when the market moves against me, in which event I simply re-open it.

Futures trading is also of value when you identify a crypto asset that is in a downward trend or even a death spiral, in which event you can profit by shorting it against BTC at Bitmex. Look at XRPBTC slowly sink by 90% from 21,000 Satoshis to 2,210 Sats over the period 18 May 2017 to 3 December 2017.

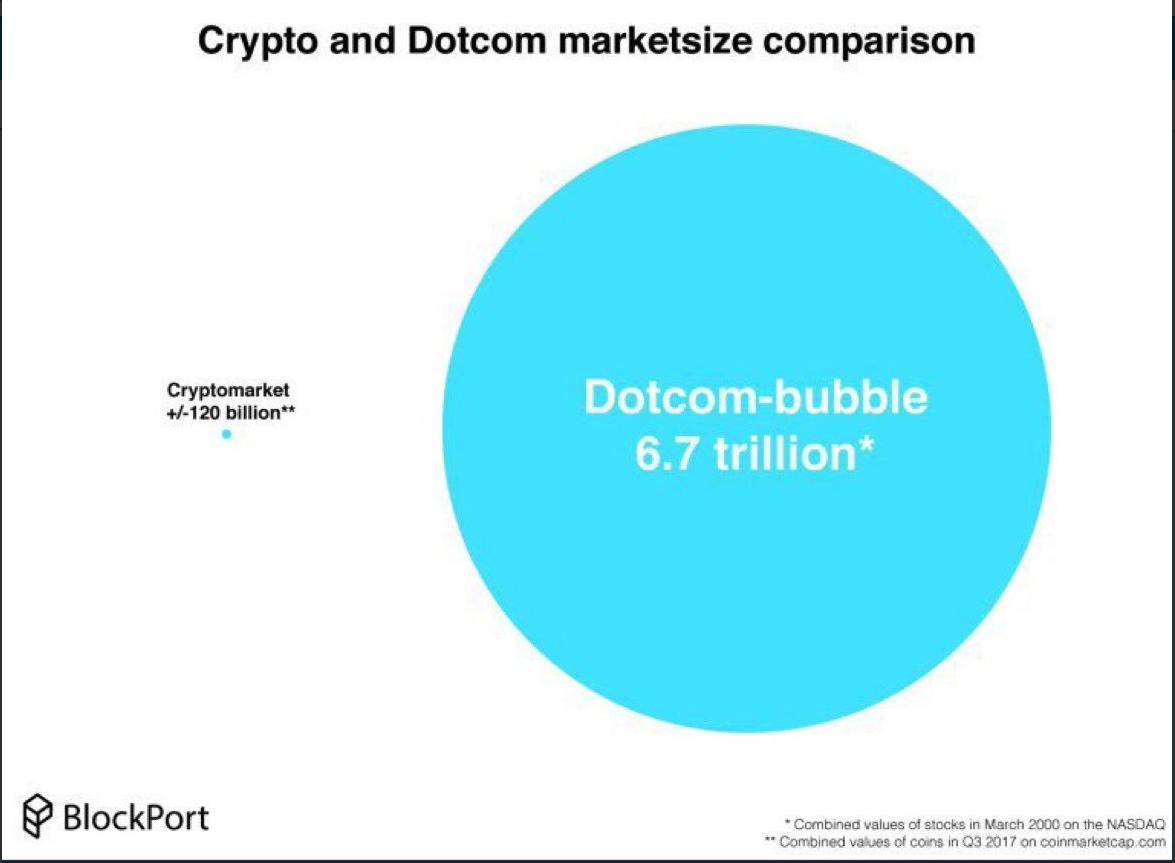

Also, the day might come when the crypto market goes into a prolonged period of funk or decline. Like DotCom in the Spring of 2000. If you are skilled at trading on margin you can use that as an opportunity for gain.

#Trading Tip 28 November 2017: Buy Binance Coin $BNB. Trading volumes of cryptoassets are exploding. More Bitcoin is traded daily than Apple or Amazon stocks. How to leverage this phenomenon into trading profit? Binance Exchange is a new global exchange that has quickly entered the top 10 exchanges by trading volume, and rising. They issue their own utility coin.

The price of $BNB can be expected to rise non-linearly with the exchange’s growing volumes. Buy Binance Coin here.

#News 6 November 2017: I keep a crypto trading diary that I regularly update with trading recommendations.

The Ten Rules

31 December 2017: Performance of my Portfolio:

Since Entry June 2014: Portfolio is x 46.5, i.e. has increased 4,550%. My average Bitcoin buy price (June 2014 to December 2015) was $540. Bitcoin (at its current $13,947) is x 25.82, increase of 2,482%.

Year to Date (YTD) 2017: My portfolio is x 22, i.e. has increased 2,100%. Global Cryptomarket is x 33.62, increase of 3,262%. (From $18.2 billion to $612 billion.)

The main successes in my portfolio have been $BTC, $ETH, $EOS (ICO), $XTZ (Tezos ICO), $ZRX (0X ICO), $BNB (Binance Coin), $POWR, $BCH, $BCO (BridgeCoin).

The Golden Rule: Build your Portfolio on Bitcoin, not on any altcoin. Buy Bitcoin at Coinbase. (You will get $10 of free Bitcoin using this link.)

- ‘When you See it, Bet Big.’ George Soros

- Index Track the Top 10 Cryptoassets

- Scale Out (Take some Profits)

- The Honeybadger Trade: Buy the Dip on Margin at Bitmex.

- Do not Over-Trade. Lock up Coins

- Let Profits Run. Cut Losses. Watch 7d Price Change not 24h or 1h

- ICOs are a Great Opportunity. Do Your Own Research.

- Research Micro-Caps that might rise by Orders of Magnitude. (I like KucoinShares $KCS. Buy at Kucoin Exchange.)

- It can pay to go long or short on margin. Buy (and Sell) Bitcoin on margin at Bitmex Exchange. Use margin if you want greater, faster returns (at a higher risk).

Rule 1: Build the Portfolio on Bitcoin

Bitcoin is the mother lode. It has been good to me and will always form the main part of my crypto portfolio.

Those (mainly low-income copy & paste journalists) claiming Bitcoin is in a bubble are too lazy and/or stupid to become informed. There is no Bitcoin bubble for these reasons.

Growth

Bitcoin has had phenomenal growth in its price and MCap since inception. If we exclude other cryptoassets, Bitcoin has been the best performing asset in the world every year since 2009 through to December 2017 with the exception of 2014. It has beaten all global currencies, equities, commodities, bonds, ETFs, real estate throughout that period. Bubbles are by definition short-lived, they do not keep bubbling for eight years.

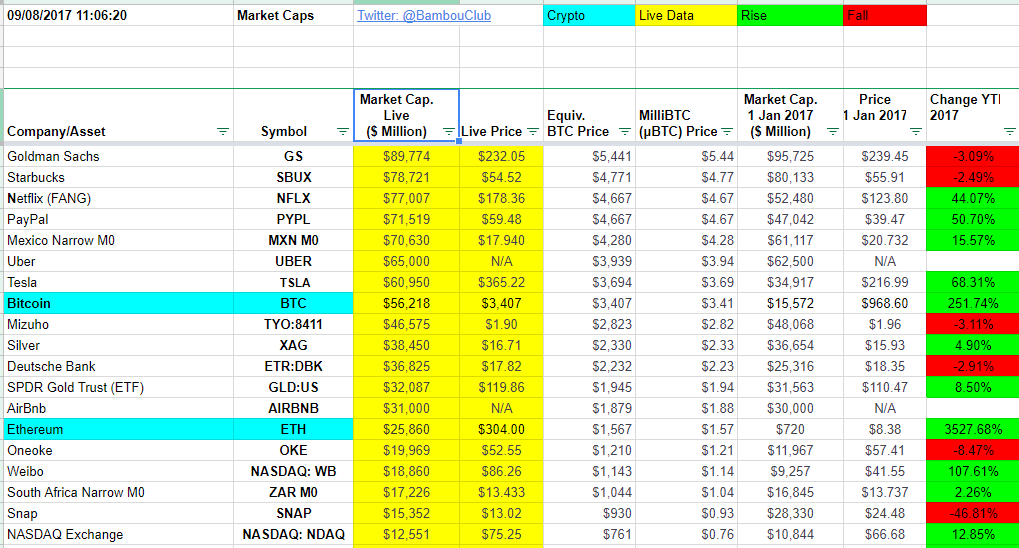

As a result it has achieved a MCap of $56 billion and this place in a global table of iconic assets.

Trading Volumes

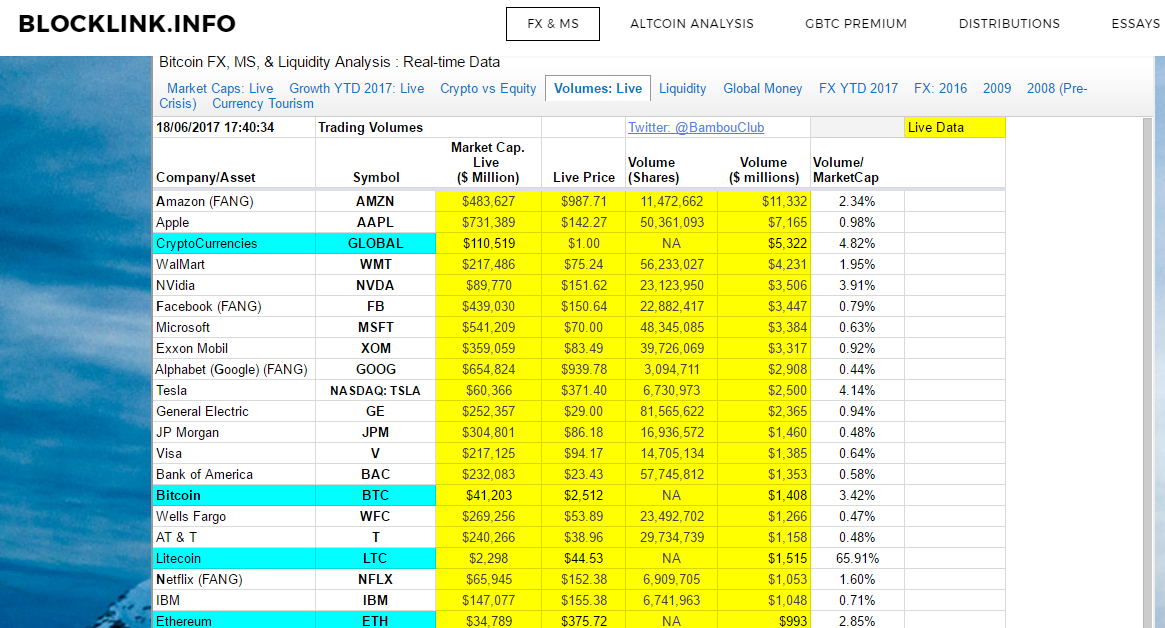

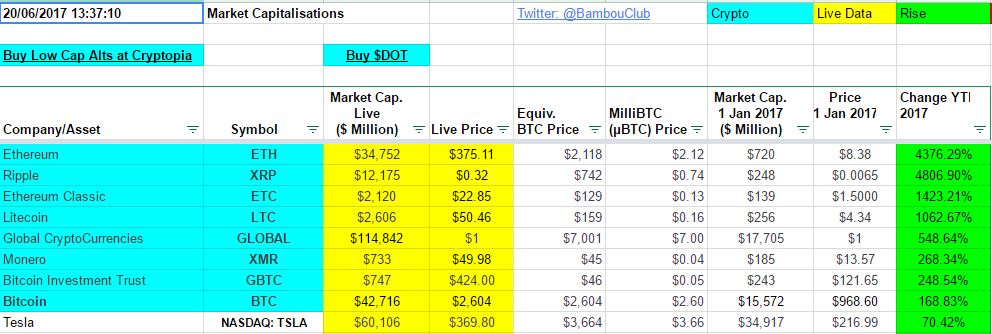

Volumes indicate the liquidity of an asset. The greater the liquidity the easier it is to buy and sell, even when there is turmoil, and the lower the Bid-Offer spread and therefore the cost of trading. You want to avoid assets with tiny liquidity as when the shit hits the fan it will be costly to exit. Bitcoin has world-class liquidity. I run a crypoasset analysis site named Blocklink.info. Here is a screen-grab of the most liquid assets in the world.

Source: Blocklink.info. Volumes for cryptoassets are fetched from the Coinmarketcap API using the CRYPTOFINANCE Google Sheets Add-On. Volumes for stocks come from Google Finance. You can check the US stocks volume at the NASDAQ site.

Bitcoin’s trading volume is up there with the great iconic American stocks.

Things like this are gold when I'm trying to get institutional investors to take the space seriously. https://t.co/XypK4ojTXL

Bitcoin’s price will continue to be volatile, but Bitcoin is travelling along a secular bull trend road, and that spectacular volume is not going to evaporate overnight.

Transaction Fees

Every month fees are ever higher which is watertight evidence of ever greater demand to use Bitcoin. That is, people want to send transactions across the blockchain, not just trade on the exchanges.

On average, it now costs more than $5 to transact on the Bitcoin blockchain! ��

Tx fees time-series data is maintained at Blockchair.com

Bitcoin and My Portfolio

Bitcoin holds a dominant place in my cryptoasset portfolio. As a result of recent changes in UK regulations I have allocated my entire personal pension (like a US 401k or retirement account) into Bitcoin via the XBTProvider ETN.

Be more cautious about investing your 401k into Barry Silbert’s Bitcoin Investment Trust $GBTC. The (European) XBT Provider ETN is an open-ended fund which means it maintains a premium to the NAV close to 0% at all times. The Bitcoin Investment Trust is an inferior investment vehicle because it is a closed-end fund (it does not increase its holdings of the underlying asset when demand for the product increases) which means it is subject to wild swings in its premium, which has been as high as 150%. So you could make the mistake of buying when the premium is high and suffer swingeing losses even when the Bitcoin price is stable.

Rule 2: “When you See it, Bet Big.” George Soros.

Something extraordinary is happening. The cypto space in June 2017 is like the Internet space in 1995. It is a great opportunity.

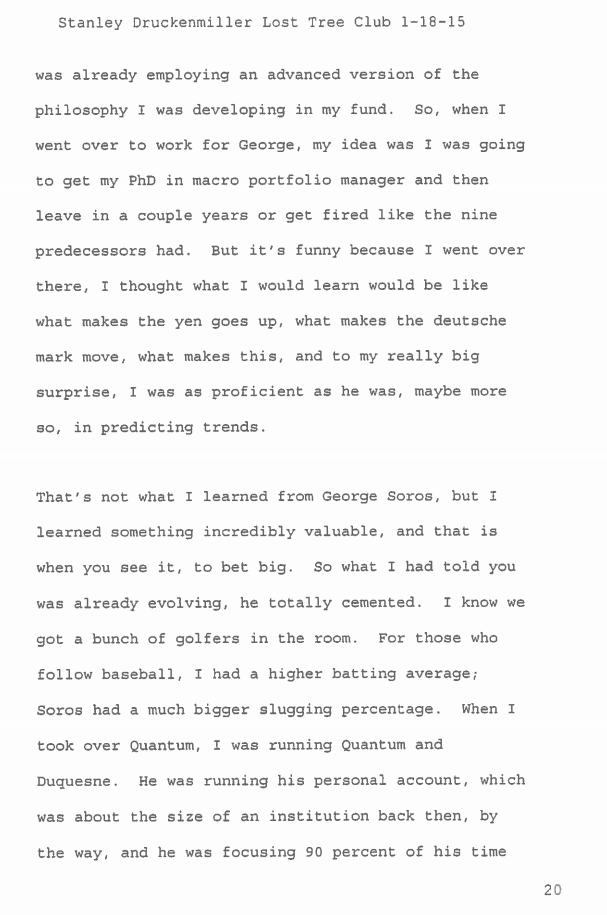

Stanley Druckenmiller has written about his dealings with George Soros whom he quotes as saying ‘When you see it, bet big’. The funny thing is, I was mocked by a Hedge Funder on Twitter named Sarah Cone (@impcapital ) when I revealed that I had seen it and I had bet big. I bet big with my entire fucking pension.

George Soros: When you see it, bet big.

@zaoyang @BTCoinInfo When you see it, bet big. @Impcapital mocked me when I revealed I had invested my entire pension into a Bitcoin fund. @AriDavidPaul

@zaoyang @BTCoinInfo @impcapital @AriDavidPaul My pension is up 83% since 26 June 2017, or 108% if you factor in Bitcoin Cash airdrop.

@zaoyang @BTCoinInfo @impcapital @AriDavidPaul And it's not a small pension - built it working on dev. of risk management systems for interest rate derivatives at banks all over the globe

Here is Charlie Munger expressing a similar thought:

The wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds." https://t.co/RxuDNKwnNz

Rule 3: Index Track the Top 10 Cryptoassets

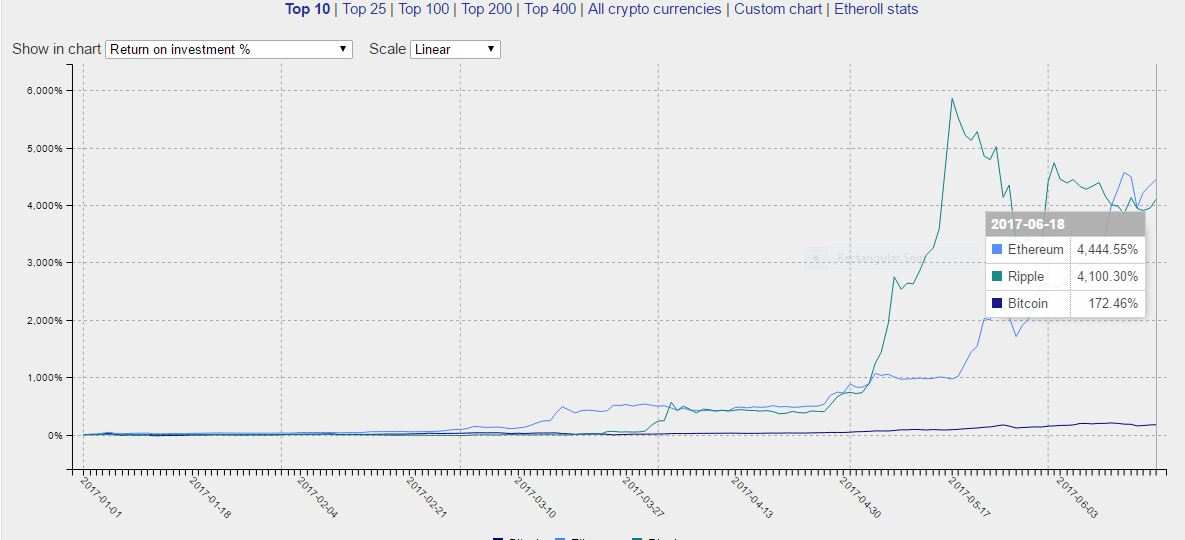

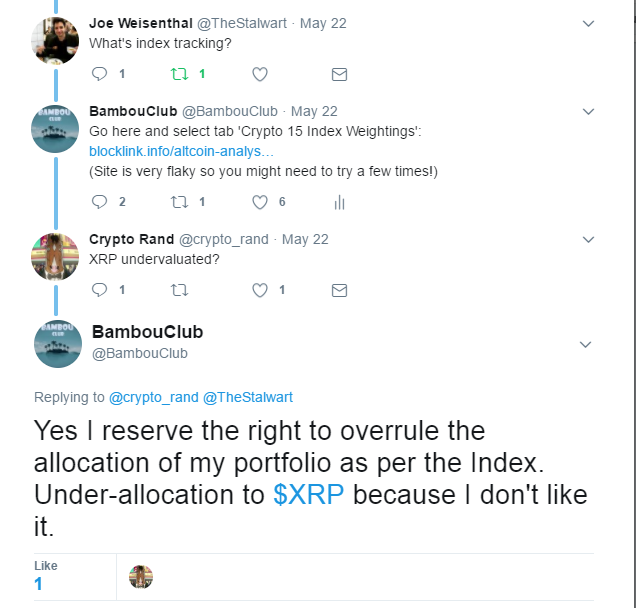

Until 18 May 2017 I held very little Ethereum and zero Ripple in my portfolio.

I made a great mistake in not buying Ethereum and Ripple in 2017 until 18 May. My mistake was Bitcoin Maximilism. I refused to have anything to do with Ethereum and Ripple because I didn’t like them. As a result I missed these returns.

Source: CryptoCurrencyChart

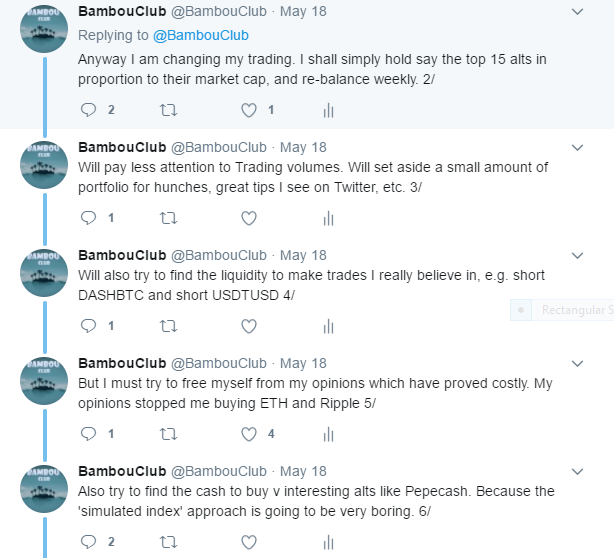

I came to my senses on 18 May, 2017 when I underwent an epiphany. I then made a new (self-imposed) rule : broadly track the Top 10 cryptoassets in my portfolio, regardless of my opinion about their individual merits.

I look at this and think what the fuck was I doing? I have done OK in 2017 - my return of 106 > 89% of Bitcoin, but not great.... 1/

I have applied a flexible, discretionary form of index-tracking since then.

@BambouClub What's index tracking?

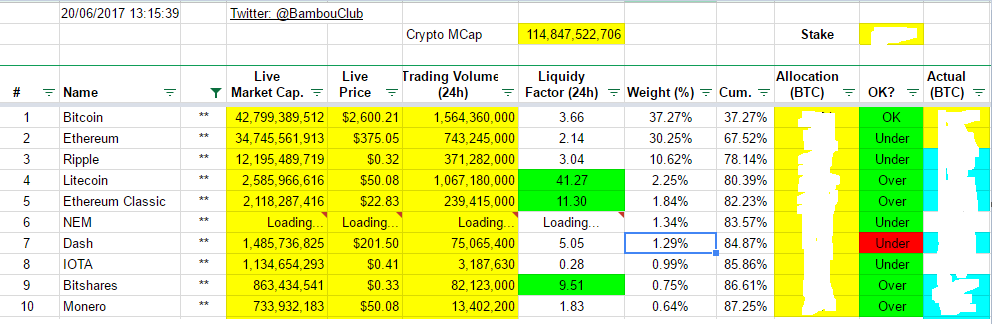

I execute index-tracking manually off this Google Sheet:

This deranged Alt market started 1 March 2017 & is now 80 days old. Took me 80 days to abandon 70-30 Rule and switch to Index Tracking.

Executing my new Index Tracking plan, had to buy loads of $ETH and $XRP & some $XEM. Feels weird. Must buy $DASH $BCN at the next red candle

Index Tracking means you get to surf every big wave.

@BLKchain and index-tracking is liberating. You don't have to worry, 'oh ETH is expensive at $100'. Just buy it as per the required allocation.

Started tracking the crypto index 18 May 2017. So benefited from rise in $ETH but lost on fall in $XRP.

At the time of writing, 20 June 2017, the results of index-tracking have been pleasing.

YTD 2017 returns for Cryptocurrencies, 18 May 2017:

My portfolio was up 106% YTD.

YTD 2017 returns for Cryptocurrencies, 20 June 2017:

My portfolio was up 281%. So in one month (18 May to 20 June) it has raced past Bitcoin, $GBTC, and Monero, and has made good ground in catching up with Global Cryptocurrencies.

I ruled myself free to apply discretion in my index-tracking. It was very clear early on that Ripple was in a secular bear market against Bitcoin from 18 May and I quickly became and stayed underweight in Ripple.

Decided to track the crypto index (& thus to buy some $XRP) on 18 May, the exact date that the $XRP bubble popped! Good decision, bad luck.

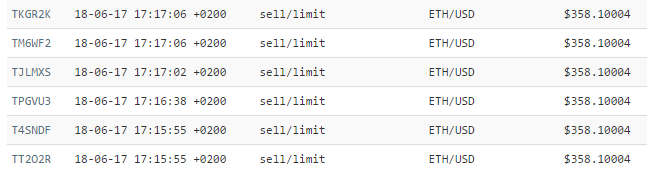

I also went underweight in Ethereum in mid-June at $350 — $360.

Why? Because:

Is Ethereum in a bubble?

I don’t know. Applying the same metrics used above to $ETH it does pretty well, but not as well as Bitcoin. But there are clear risks and as a result I am underweight in Ethereum compared to its share of the global Cryptoasset Market Cap.

Growth (Price & MCap): Ethereum has outstanding growth in its short life, but it was only created in August 2015 so it lacks the 8-year track record of Bitcoin. This is significant. Ethereum’s explosive performance in 2017 could indeed fit into the time-frame of a bubble.

Trading Volumes & Volume/MCap Ratio: Great. Similar to Bitcoin.

Transaction Fees: All good. They are rising quickly indicating true demand for this cryptoasset.

amp; average transaction fees ��

Source: Bitinfocharts.com

Metrics aside, Spencer Bogart makes great sense in this thread where he describes the regulatory risk and other risks that might bring the Ethereum house of cards down. It is possible that the SEC will rule that the ICOs are illegal sale of securities. People might go to prison. It is for these reasons that I am under-allocated.

1/I want Ethereum to succeed and stand to gain from its continued success. That said, I have a three major concerns about ETH price outlook:

NO NO NO. There is no such thing as "grey" and you WILL go to jail. Learn from my mistake https://t.co/HCDqNwxYde

Note: If Governments decide to put a stop to the cryptoasset economy, there is a crucial distinction between Bitcoin and Ethereum. Bitcoin is truly decentralised. It has honeybadger, even cockroach qualities and is resistant to such measures. Ethereum is a registered commercial legal entity in Switzerland and can be shut down overnight.

@laurashin @derosetech @BambouClub @jimmysong @atlantatech Here's the commercial register entry for the Ethereum Foundation (German, but google/translate) hope it helps https://t.co/6mqydHC5BB

Rule 4: Scale Out (Take Some Profits)

Anyone who has lived through a bubble knows the value of this.

I have experienced several bubbles, namely London housing 1984–1988, DotCom in 1998–2000, London housing again 2002–2008, the Bulgarian property market (seaside apartments and ski apartments) 2004–2008.

It’s human nature to be cautious at first and then progressively relaxed, even reckless. My observations suggest that it is best to behave in the opposite, counter-intuitive way: commit yourself to the market with reckless abandon in the early days, and then start the scaling out process, applying the brakes and get the hell out when it appears to be the later stages.

In all those bubbles I made great paper profits that disappeared in a matter of months. The paper profits were more than 2 million Euros in the Bulgarian property market. In none of them did I take profit off the table in the run-up. Christ did I regret that. I am taking profit off the table in the cryptoasset market.

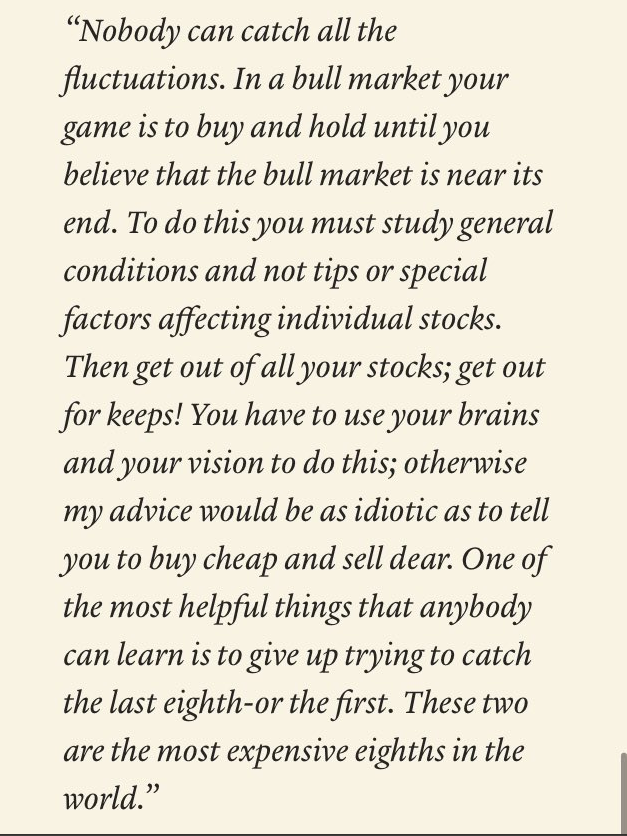

Finally, at the end, you must scale out completely. Jesse Livermore’s advice for a bull market:

It is not my opinion that we are near the last eighth:

Rule 5: The Honeybadger Trade: Buy the Dip.

Lots of influential actors — Governments, banks, regulators — fear Bitcoin and try to kill it on a regular basis. Bitcoin takes massive hit after massive hit, but it has always rode the punches and bounced back. Experienced traders have noted this and the advice is to buy the dip. This is the Honeybadger Trade.

I like the idea of BTFD, as I truly believe in Bitcoin. BTFD! people on Twitter yell. But it has puzzled me for a while.

There is actually no point in watching this bloodbath. People say BTFD but with what funds?

BTFD requires having liquidity before the dip, indeed at all times. And that means not maximising BTC during bull runs. It is hard.

There is a solution. Buy on margin at the dips. The beauty of this is that you do not need to add funds to your account, you merely avail yourself of the leverage already available. Use Bitmex Exchange.

I permit myself to use margin in the specific case of BTFD.

You need to get the timing of BTFD right. Beetcoin on Twitter provided this great analysis (thread) demonstrating that you should stay out for the first 48 hours of a dip and then BTFD.

Bitcoin - Previous bubble trend correction: 2013 1st bubble (6): -25% lasting 6.3 days 2013 2nd bubble (5): -33.6% lasting 7.2 days

Do NOT Sell the Dip

You need to be clear, is this a dip or is it a secular bear market? I BTFDd relentlessly in the DOTCOM unravelling in 2000 and lost every penny in the end.

If it is an established, secular bear market then face the music and STFD.

Rule 6: Don’t Overtrade. Lock up Coins

I over-trade stupidly at at tiny whims when I am bored or drunk. A solution I have found is to lock coins away out of reach.

One way is to keep Bitcoins and others in your hardware wallet. I use Trezor. It can store Bitcoin, Ethereum (+ all ERC-20 tokens), Ethereum Classic, ZCash, Litecoin, and Dash.

Another way is to lock them into terms deposits at Cryptopia (applies only to Dotcoin). This gives you the added benefit of earning interest on coins at interest rates that just do not exist outside crypto (about 18% p.a.).

Rule 7: Let Profits Run. Cut Losses.

This guy turned $10,000 into $6 million by letting his profits run during the Ethereum run-up in the first half of 2017.

Today I hit my goal. I've turned $10,000 fiat into 20,000 $ETH tokens and a nice side of $GNT in 7 months and 2 days. Cheers Twitter

Run profits Cut Losses is hard to do exactly. In my P&L Sheet I focus on the 7d (Price Change over 7 days) to decide whether to re-allocate my portfolio according to this rule. I largely ignore 1 h and even 24 h .

Rule 8. Treat ICOs and other Examples of Herd Mentality with Care

In general you are better off holding Ethereum than going through the mad, greedy, FOMO process of buying ICOs.

Odds have been against you picking a token sale that outperforms #Ethereum's $ETH �� https://t.co/y5TABTPpW8

2/ Picture is different if you swapped from #bitcoin into a token sale. Stay tuned, the story is still being written https://t.co/CabX9YKpsQ

But ICOs or coins newly released on the exchanges can be great investments. Beetcoin played the IOTA new release on Bitfinex like a master. He turned 10 Bitcoin into more than 200 Bitcoin.He bought the $IOT Over the Counter (OTC) some time before Bitfinex listed it. He was ahead of the herd.

iota - Coz you just heard about it here before it becomes mainstream. Bought 1 Ti = 10 BTC (otc) Current 1 Ti = 36 BTC $134M mktcap

iota - Current 1 Ti = 48 BTC (ATH: 56) $238M mktcap �� $iota

iota - Current 1 Ti = 235 BTC ���� $iota

Rule 9 Do Your Own Research. Examine Micro-Caps.

I respect this strategy.

For every ICO, I'm instead looking for comparable projects at lower marketcap, especially if they're tech-superior.

@MOpinions Up huge on $BLOCK compared to Cosmos' ICO value, probably going to do very well on $XEL as compared to $GNT.

I haven't been this excited for a #cryptoasset release since $ZEC. Intro to @elastic_coin $XEL by @Soul_Eater_43 https://t.co/rU31TWA1LB

@MOpinions Up huge on $BLOCK compared to Cosmos' ICO value, probably going to do very well on $XEL as compared to $GNT.

I bought Elastic $XEL at the obscure Heat exchange. It was rather difficult discovering how to buy it because I was in this case ahead of the herd where the path was not well defined. In the end I bought it at a high price (average 31,367 Satoshis, should have got them at 25,000 Sats) as I got scammed over at Heat by a predator (Arsonic @Ars0nic on Twitter) playing the order book. We’ll see how that plays out. I think the excessive price I paid will not matter too much.

This is the strangest order book for $XEL. The offer is 10x the bid!

Price of $XEL now 25,000 sats i.e. MCap 15,328 BTC / $40 million $GNT is $520 m. https://t.co/ExjbTeJfSQ

@notsofast @dandidanillo @Crypto_God It was like a Hollywood movie. I was lured into Heat and played like a river salmon. Skilled stuff. My losses were small & money well spent.

Rule 10 Be Careful as Hell with Leveraging

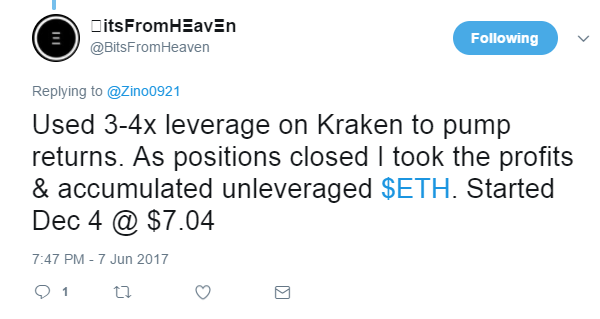

Obviously leveraging can work, as with the guy referenced above who has made $6 million relentless buy Ethereum on leverage since December 2016.

I take out the rare leveraged position at Bitmex Exchange.

It can also go horribly wrong when margin calls occur across the mass market.

Here's How Traders Lost Millions in the First Ethereum Flash Crash https://t.co/U4QlU1WbrP via @motherboard

That said, those who lost everything were not the brightest traders. They could have avoided that by using judiciously set Stop-Limit orders, rather than plain Stop orders.

The mistake those ETH traders who lost everything was they used Stops but not Stop Limits: https://t.co/AHRAXB7Umb

So that is the Ten Rules.

I keep a crypto trading diary that I regularly update with trading recommendations.

If you liked this please Clap and Follow me on Twitter: @ BambouClub

Original article and pictures take cdn-images-1.medium.com site

Комментариев нет:

Отправить комментарий