Summary

Bitcoin's volatility seems to be histrionic in nature.

Cryptocurrencies do not match historic bubbles.

Ethereum is the better, faster, and more versatile bitcoin.

Let's talk about two cryptocurrencies: Bitcoin and Ethereum and why Ethereum might be better.

What or Who Determines the Price?

Now, though some will tell you they know exactly where it will go and exactly why, I can almost guarantee you that they are either lying to you or they are lying to themselves. If you ask any economist to take a look at Bitcoin, they will tell you the same thing. The ONLY thing that is currently determining the price of bitcoin is supply and demand. All other factors are entirely endogenous factors which can be captured by the effect of supply and demand.

Now this isn't a bad or good thing. It is simply the state of affairs. Some would argue that the same stands for all assets: stocks, bonds, or whatever. And they aren't entirely wrong. With any of those asset classes, there is some tangible value behind them. Whether it be the physical assets the company holds or the cash flows a company generates. So using the assumptions of the efficient-market hypothesis, we can say that if markets behave rationally even some of the time, then the pure effect of supply-demand and individual daily sentiment should not be able to move any individual security down to zero without a rational cause.

But the environment which listed public securities operate in is different from that of cryptocurrencies. Public markets have a lot of oversight, regulatory structure (Rajgopal and Venkatachalam 1997), as well as institutional investors which act as values and levies to relieve some of that downward pressure on financial markets. Unfortunately for bitcoin, it does not have any of this, at least not yet.

With the recent rise of Bitcoin, institutional investors are beginning to take notice. Hedge funds have now entered the market for the prized asset, while new hedge funds have begun to complete financing rounds for cryptocurrency-specific funds. All this is to say that institutional investors will add to the demand side initially.

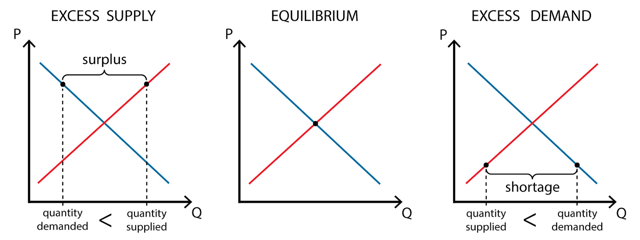

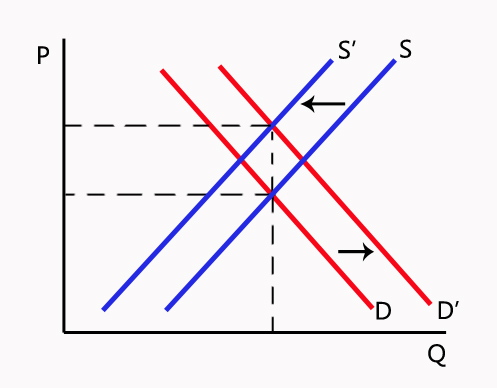

Now, I have mentioned the supply and demand quite often so far. So a quick flashback to econ 101; above you can see a standard supply and demand curve. Now, let us for one second assume perfect price elasticity of demand and look at the charts in the context of bitcoin. As demand for bitcoin increases, and as the hype surrounding bitcoin grows with its price, we can see that a seemingly endless positive feedback loop forms. In other words, people demand more bitcoin as the price increases, which in turn leads to an increase in the price which leads people to demand more and so on and so on.

In addition to this, the cryptocurrency is viewed by most as an asset rather than a currency. The result of this is a tendency to hold the asset rather than use it on a transaction basis. This means that as people demand more, the people who hold bitcoin are less willing to sell at the current price due to the probability of future appreciation. All this can be described in the graph below. The chart represents the quantity of bitcoin willing to be bought or sold in a marketplace. Do not mistake this with the total number of bitcoins outstanding. As you can see from the chart, this iterative process drives the price rapidly higher.

News and Volatility

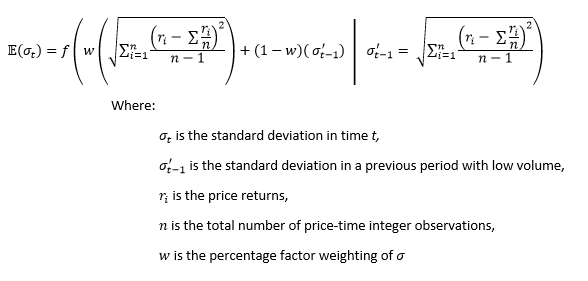

People point to positive news about various companies accepting bitcoin as the validity of the coin price. Which is correct and wrong at the same time: yes, it does have validity to it as a currency, but it makes no inference to its price. The price solely increases because to investors the risk has gone down. Strangely, however, the implied volatility of bitcoin is so high that any of these reductions to risk will send the price skyrocketing. Now there are some reasons for this; primarily it seems that the high volatility has become part of the identity of bitcoin. Mathematically a simple version of this suggests:

Note: The equation above is a working histrionic model, which I am developing and is highly subject to change. I am including it for illustration purposes, not for practical asset pricing.

I know it may seem overly complicated, but what it is suggesting colloquially is pretty straightforward. It is saying that currently it appears that the expected volatility of a bitcoin is codependent on the current implied volatility as well as some weighted factor of its past volatility during a period of characteristically high volatility given this past period volatility. Now given that Bitcoin's price only fluctuates based on supply and demand, this means that the histrionic model above, or a variation of it, is caused by people's expectations for it to occur.

Is it a Bubble?

I realize 100% that this question just triggered almost all of you. This is a phrase that has been repeated over and over again by naysayers. The opinion is that this is just a baseless slogan that means absolutely nothing and is only said by people who do not understand what cryptocurrencies are. Now no one can tell you for certain that it is or is not a bubble. But let us look at some historical examples and then see if there are similarities and differences.

Perhaps Bitcoin is the poster child for disruptive technologies. It definitely has the potential to entirely revolutionize our entire society. When Henry Ford introduced his Ford Model T, there were those that thought it was the most ludicrous idea ever. Yet, today, our entire infrastructure globally is built around his invention.

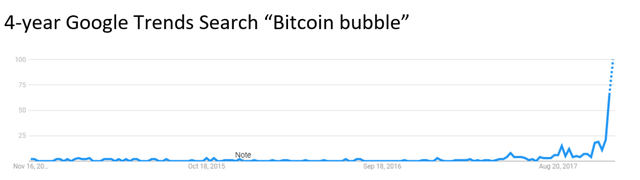

(Source: Google)

The chart above does look scary. A large number of people seem to have gained interest in whether bitcoin is a bubble or not. So let's take a look at the two best historical examples of bubbles and see what we can learn and how to navigate forward. And if currently popular cryptocurrencies resemble anything like either of those bubbles that burst so violently.

In the early 1600s in the Netherlands, a series of events occurred which are now referred to as Tulip Mania, where the price of tulips were viewed as highly coveted. Prices of tulips erupted and skyrocketed higher. Now there are highly contesting reports around the exact prices of its enormous ascent due to the lack of existing data, so I won't include a chart here. But they are accounted, though unverified, that a single tulip bulb sold for 10 times the annual income of a craftsman. One classic popular account claims a single bulb was used to purchase 12 acres of land (Mackay in Extraordinary Popular Delusions and the Madness of Crowds).

Now here is why this comparison at first seems good, but if you look at the actual existing facts, it really isn't. First of all, I do not need to point out that the era of Tulip Mania was over 350 years ago. Secondly, the circumstance of the tulip bubble is highly contested. Thompson 2006 postulated an interesting rationale for the Tulip Mania. Tulips are a seasonal flower, and as such, they traded essentially as futures contracts (contracts between growers and buyers at the time). The issue arose when the regulation was placed which allowed to pay a penalty fee of 3.5% to void the end of the contract. This entirely disrupted the payoff matrix for the future, basically allowing the buyer the right to buy at a higher price but no obligation at a lower price (now this is known as an option). The introduction of this option pricing structure to futures incentivized the holding of contracts which then is suggested to have led to the monstrous rise in price.

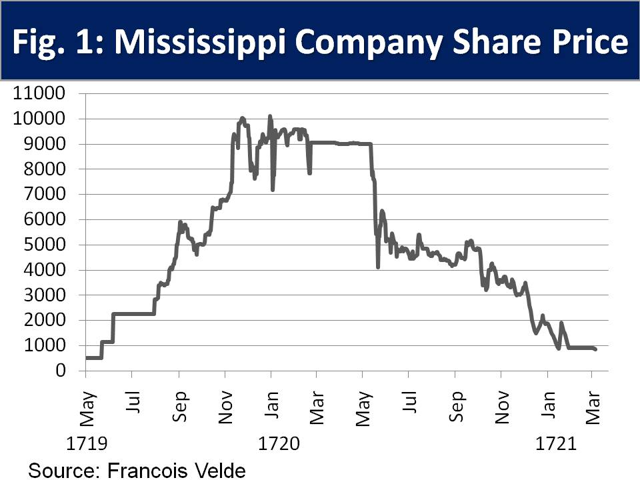

The second example is the Mississippi Bubble of 1718. Now this economic bubble is well documented, and there are some fantastic books written about it if you are interested. But I will give you a quick summary. In May 1716, John Law started a private bank with the majority of its capital being linked to government notes. Soon after he created a joint-stock company called Compagnie d'Occident (the Mississippi Company), the company had a monopoly over trade with the West Indies and the North American colonies. That soon after in 1718 became the Royal Bank, meaning that it was guaranteed by the king, and then absorbed all its competition for trade of China and the East Indies. The result was an agreement which stated that the national debt would be paid off by revenues from the Mississippi Company. Law exaggerated the wealth of the Mississippi Valley, namely its rich mineral deposits. The result was a mania for the joint-stock company. The company stocks and its violent appreciation demanded the issuance of more paper bank notes. By 1720, the craze had spiraled almost out of control and the French government admitted the paper notes exceeded the total value of its coinage which ultimately burst the bubble.

(Source: Francois Velde)

So what's the point? How does any of this relate to the price of Bitcoin? The answer is these two bubbles had definable and short-lived catalysts that broke some of the standard practices of finance that have evolved over the centuries. In the case of Bitcoin specifically, we haven't seen that catalyst. Perhaps the reversal of CBOE futures on the cryptocurrency will save it from the possibility of a catastrophic collapse.

Now, why did I say if these historical bubbles look like cryptocurrencies and not just Bitcoin? Well, the answer is simple: there exist other cryptocurrencies which follow similar trends as Bitcoin (obviously). After the reversal of Bitcoin futures, the price took a dive and has rocked around $14-15K, down from its $19K highs. Now whether it can muster the strength to recover remains to be seen. However, I believe there is a much more attractive opportunity which remains for investors: Ethereum.

At a glance, the two look like very similar stories. Some random virtual currency with violent growth. Yet, a closer look reveals how different Bitcoin and Ethereum are. First and foremost, they are almost entirely different: in design and purpose. Though they both use blockchain technology, Bitcoin was designed specifically as a digital currency. Yet, transaction confirmations take up to several minutes with Bitcoin, making it entirely unviable for long-term widespread use (this was one of the reasons for the Bitcoin Cash fork). For Ethereum, transaction confirmation takes several seconds.

While coded differently, Ethereum's main advantages come with its SmartContract and Distributed Applications uses. Basically, in a nutshell, Ethereum allows for various specialized peer-to-peer programs and specializations to be built into each token without any downtime. Such versatility and security will surely give it a sharp advantage in the long-term over Bitcoin.

So what exactly is a "SmartContract"? Well, it is a protocol which allows for two parties to negotiate and verify an agreement virtually without a third party. Without the third party, transaction costs are significantly reduced while security is increased. The reason for this is that the terms of the deal can be virtually embedded and verified by the blockchain itself before any funds are transferred.

To add some icing on the cake, Ethereum also is backed by a rather large non-profit which oversees the platform's advancement and development, a centralized development hub for a decentralized platform. For those investors who are still eyeing cryptocurrencies, I recommend betting on the best horse for the long-run race ahead. My bets are placed on Ethereum. Stay tuned. Happy hunting.

Disclosure: I am/we are long ETHEREUM.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Original article and pictures take static2.seekingalpha.com site

Комментариев нет:

Отправить комментарий